The rare earth element (REE) industry stands front and centre in Malaysia’s high-tech development scenario and has immense potential. From 2024 to 2032, the global REE market is expected to expand from US$3.74 billion (RM16 billion) to US$8.14 billion, with a compound annual growth rate (CAGR) of 10.2%.

Malaysia can expect to monetise REE deposits to the tune of RM209 billion, with an expected contribution to GDP of RM9.5 billion as early as 2025. In the longer term, the country can expect to generate 6,550 new jobs.

“The National Advanced Materials Technology Roadmap 2021-2030 stipulates that a comprehensive value chain strategy for REE is a critical component in driving high-tech growth for Malaysia and is one of four main game changers along with multicrystalline nanocellulose, nitinol and graphene,” says Rushdi Abdul Rahim, President and Chief Executive Officer of the Malaysian Industry-Government Group for High Technology (MIGHT).

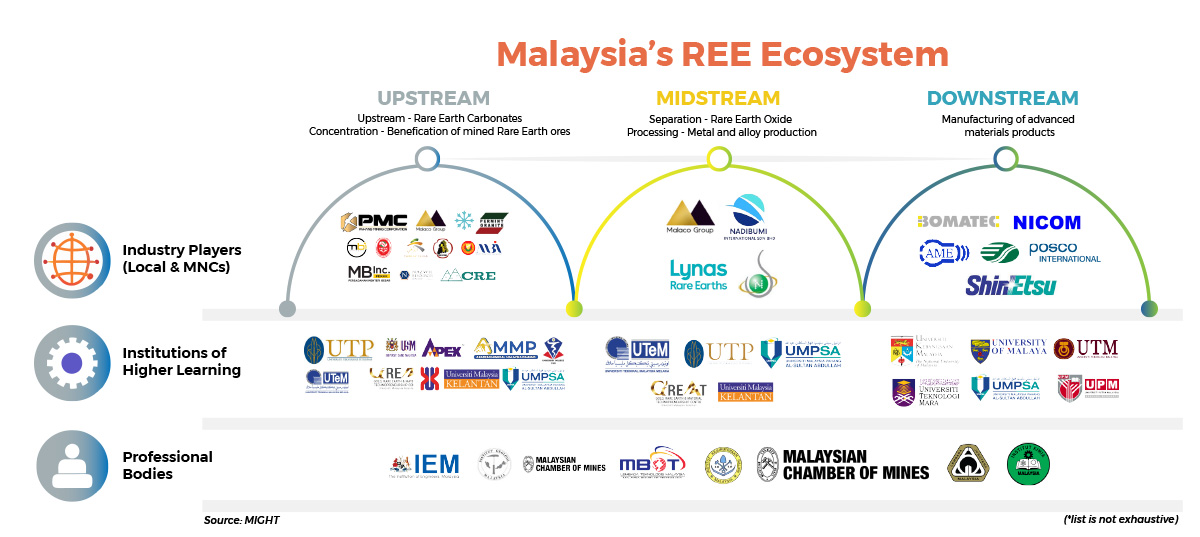

“MIGHT consistently adopts a comprehensive ecosystem approach to industry development, and through industry-driven measures intends to collectively boost business opportunities in the REE sector while providing strategic advisory services. Through the National Advanced Materials Consortium (NAMC), under the purview of the Ministry of Science, Technology and Innovation (MOSTI), we have garnered participation of over 20 REE upstream, midstream and downstream industry players, public agencies and the academia focusing on strengthening an otherwise fragmented value chain,” he adds.

Increasing demand for REEs

REEs’ criticality is often attributed to their presence in a myriad of high-technology products, including electric vehicles (EVs), wind turbines, screen and vibration technologies utilised in telecommunications, as well as for healthcare diagnostics and treatment — for example, in magnetic resonance imaging (MRI).

Their applications in the defence sector, from night vision goggles to nuclear submarines and military weaponry such as aircraft and missiles, elevate the race to one of geopolitical significance, with the US and China as main contenders. Consequently, the International Energy Agency forecasts that the demand for REEs will increase three- to seven-fold by 2040, with critical materials such as lithium possibly facing a 40-fold increase.

“The groundwork for Malaysia’s REE-based industry has been largely established through policy frameworks outlined in the National Mineral Industry Transformation Plan 2020-2030, New Industrial Master Plan 2030 and Blueprint for the Establishment of Rare Earth-Based Industries in Malaysia, among others,” says Dato’ Ir Abdul Rashid Musa, Chief Mobility & Innovation Officer / President of the Aerospace Division of UMW Holdings Bhd.

“The next step is to ensure that the nation optimises the potential of the estimated 16.1 million tonnes of non-radioactive REE deposits, currently valued at RM800 billion, and this can only be achieved through robust and targeted industry development.”

By the year 2030, the downstream production of Malaysia’s non-radioactive rare earth elements (NR-REEs) is forecast to attain revenue of RM13.59 billion, mainly in the production of super magnets and electric motors. These, in turn, move along the value chain for further product integration by systems integrators and original equipment manufacturers (OEMs).

This would further enhance the already valuable deposits of Praseodymium, Neodymium and Dysprosium, the most prevalent elements found in Terengganu, Kelantan, Perak, Pahang and Kedah. These elements, along with Terbium, are collectively referred to as “super magnets”, a crucial component of electric cars, wind turbines and electronic products, among others.

“We pay close attention to the value chain. For instance, UMW is enabling strategic collaborations with relevant parties as part of our long-term business strategy. This is a key material enabling green mobility and green energy,” Abdul Rashid adds.

The NRREE Task Force Study under the Academy of Sciences Malaysia (ASM) has estimated that by 2030, Malaysia will be able to produce 35,000 tonnes of super magnets with an investment of RM3.5 billion, alongside an annual production of five million units of energy-efficient electric motors requiring an investment of RM3 billion.

Ensuring a secure supply chain

At present, China produces nearly two-thirds of the world’s rare earth metals and maintains a tight control over exports of the minerals and related technologies critical for semiconductor and EV production. While this has decreased since its peak of 97% in 2011 to 70% in 2022, China still maintains an 85% control over processing capacity.

“What is less discussed, however, is China’s technological build-up. Between 1950 and October 2018, China filed more than 25,000 patents in REE — far exceeding the 10,000 by the US. The US, meanwhile, recently announced a minerals-security finance network with its Indo-Pacific and European allies to ensure a secure supply chain and challenge China’s global dominance,” says Rushdi.

For Malaysia, it is essential for these components to converge, beginning with the retention of a portion of the ore domestically to facilitate advancements in processing technology. Additionally, state and federal governments must resolve land use issues and develop progressive investment and financing strategies to maximise returns.

Rushdi adds: “The immediate accessibility of mined ore for midstream processing is crucial for establishing a strong downstream presence and enhancing local REE industry competencies. Notwithstanding the technological deficiencies, it is crucial to acknowledge that Malaysia possesses world-class extraction and processing capabilities, notably due to its significant expertise in the oil and gas sector, both domestically and globally. Current technologies are crossing industry boundaries, and this ‘repurposing’ is already occurring within the REE sector.”

The primary emphasis should be on technology innovations that facilitate the establishment of responsible and sustainable mining and processing methodologies.

“In reality, supply will decrease rapidly if mining is not conducted in a responsible and sustainable manner. Currently, it is estimated that only between 30% and 40% of the deposits in Malaysia are suitable for mining and are expected to last for approximately 100 to 120 years, as the remaining areas are designated as forest reserves,” says Nadibumi International President and Chief Executive Officer Dato Ir Ts Dr Badhrulhisham Abdul Aziz.

“We must also transcend misconceptions regarding REE mining and processing. Mining methods do not universally necessitate in-situ leaching or deforestation and can be conducted using safe and environmentally sustainable practices. Simultaneously, we must accelerate innovation and best practices in processing technology and guarantee that separation facilities function in compliance with rigorous safety, health and environmental standards.”